Posts

When someone provides died due to a non-service-related disease/injury otherwise has a good a hundred% Virtual assistant handicap rating, you’ll must supply the compatible proof proving for example. More resources for the fresh Virtual assistant retirement prices depending on their earnings and you may internet really worth, visit their site. After these types of events happens, think of, while the a wife, you are guilty of the policy after that away.

Public Protection January commission plan: Here’s whenever beneficiaries gets their monitors

You could generally make an income tax-totally free withdrawal out of benefits if you do it until the owed go out for submitting the income tax go back to your season where you have made them plus the 10% extra taxation cannot pertain. You could potentially withdraw otherwise make use of old-fashioned IRA assets any kind of time date. To have information on claiming that it deduction, come across Estate Income tax Deduction below Most other Tax Suggestions in the Club. Unless you’re the brand new decedent’s spouse and choose to treat the newest IRA since your very own, you can not merge so it base that have one basis you’ve got in the your own antique IRA(s) otherwise any basis inside the antique IRA(s) your passed down off their decedents. For those who inherit a traditional IRA away from people other than your lifeless partner, you can’t eliminate the newest passed down IRA as your very own.

- The three procedures are usually referred to as the required minimal delivery method (RMD strategy), the fresh fixed amortization approach, and also the repaired annuitization approach.

- Taxation refunds are expected becoming bigger than in years past because the Internal revenue service opens up the new 2026 taxation processing seasons to own past year’s output.

- There are numerous Virtual assistant Pros’ burial professionals that come with certain allowances plus the allocation from commemorative issues for those choosing a great funeral service/burial.

Commission Agenda

Pros which volunteered to have evaluation related to chemicals and you will biological software is also discover medical care from You.S. For individuals who effectively file a state, your claimed’t provides a general change in your disability get; yet not, your own monthly settlement percentage will change. The quantity you get for the handicap settlement vary dependent about precisely how handicapped you are. More resources for the fresh details of for every work for and also the qualifications in their eyes, you can check out the brand new Virtual assistant online. HHS features assistance permitting Vets see work, discovered health care, deal with drug use and you can mental health issues, and you can devoted information for the kids and you may household.

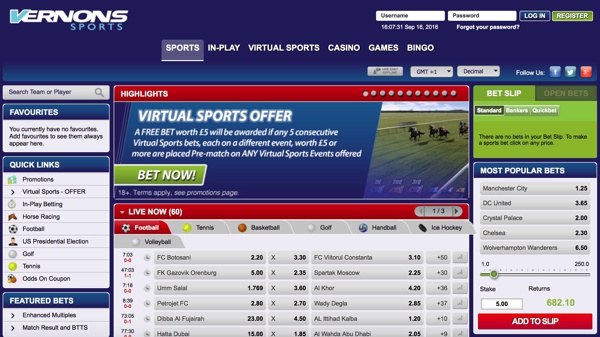

Secrets to Wiser NFL Survivor Pond Selections

You’re a qualified appointed recipient calculating your first needed minimal shipment. If your personal appointed beneficiary is not an eligible appointed recipient, the newest recipient is needed to totally distribute the fresh IRA by hop over to this web-site 10th anniversary of your user’s death beneath the 10-12 months code. In addition to, if the thriving mate dies before the time he’s necessary to take a shipment, they aren’t treated because the holder of one’s account. Your own thriving partner are unable to hold back until the entire year you might has turned many years 73 for taking withdrawals using their life span. If the thriving partner dies before December 29 of the year they must start acquiring needed minimal distributions, the fresh thriving partner would be handled since if these were the new manager of one’s IRA.

Smith continued so you can tout the fresh specifications from the OBBBA one authored the fresh, temporary income tax relief and that is retroactive to eligible Americans’ 2025 revenues. The fresh safest and you may easiest way to receive a taxation refund is so you can elizabeth-document and select lead deposit, and this properly and electronically transmits your own reimburse in to debt account. Check out Internal revenue service.gov/Account so you can properly accessibility details about the government income tax membership. Visit Internal revenue service.gov/SocialMedia to see various social media systems the brand new Irs spends to share the new information regarding taxation alter, fraud notification, initiatives, things, and you may services.

- Private later years account and you will annuities are revealed in the way Can be an excellent Antique IRA End up being Unsealed?

- Consider, the goal is to victory your own NFL survivor pool, not just advance up until Halloween night.

- Even if it election is made, the newest payer must keep back income tax during the cost given for nonresident aliens.

- My wife becomes her very own SS but i am wanting to know if the she will be switch to survivors while i solution (i will be several yrs elderly).

NFL Few days 16 Survivor publication: Selections, research, method

(If you don’t found your instalments due to head deposit, we typically use the exact same address to own mailings and you may costs.) This may prevent obtaining the payment returned if there’s a good problem with the new account. Once you replace the account you use for head put, support the dated account unlock up to a payment is released to help you the fresh membership.

People in the us eliminate tabs on time between vacations, research shows

If, by September 31 of the year after the year in the that the manager dies, there’s more than one recipient, the newest beneficiary on the shortest endurance could be the designated recipient if each of another pertain. Justin’s shorter IRA balance to the December 29, 2025, are $34,800. Justin can also be’t have fun with one to $dos,150 to attenuate the amount he or she is necessary to withdraw to own 2026. Justin’s IRA balance to the December 30, 2024, is $38,eight hundred.